The total transactions on the local bourse hit N2.35tn at the end of May, indicating a 115.40 percent increase compared to the first five months of 2023.

This was disclosed in the domestic and foreign portfolio participation in equity trading report released by the Nigerian Exchange Limited on Thursday.

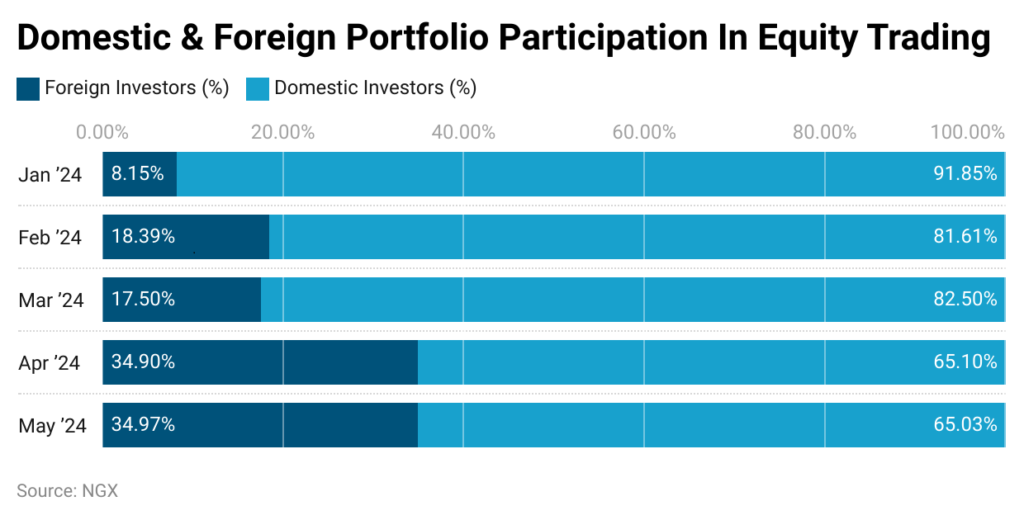

According to the report, domestic investors maintained their dominance in the market as they transacted about N1.79tn (79.63 percent) in the five months compared to N458.29bn (20.37 percent) for foreign investors.

A further breakdown showed domestic institutional investors had the upper hand at N906bn compared to N885.19bn for domestic retail investors.

Between May 2023 and this year, Nigeria has witnessed a change in leadership which led to critical reforms, including foreign exchange market harmonization and fuel subsidy removal. These two policies experts have said would boost the capital market and encourage foreign investors to return.

Within this period, the Monetary Policy Rate has been hiked multiple times to 26.25 percent at the May 2024 MPC meeting.

PwC, in its Nigeria economic outlook, titled, ‘Navigating economic reforms,’ said, “The Nigerian Stock Exchange recorded an increase of 85.2 percent in market capitalization from N30.3tn in May 2023 to N56.5tn in

May 2024.

The increase was driven partly by the positive sectoral index performance of the oil and gas (124 percent), consumer goods (104 percent),

insurance (88 percent), and banking (69 percent) sectors.

“The Nigeria 10-Year Government Bond Yield reached an all-time high

of 19.30 percent in May 2024 from 14.55 percent in May 2023. The increase in bond yields is due to attractive rates on OMO and treasury bills, spurred by the rise in the MPR.”

Month on month, NGX reported that total transactions rose from N346.23bn in April to N355.38bn in May, reflecting an increase of 2.64 percent.

Domestic investors played a pivotal role in driving the increased activity on the local bourse as their participation increased by 2.53 percent from N225.40bn in April 2024 to N231.10bn in May 2024.

Between April and May, institutional Investors outperformed retail Investors by two percent at N117.57bn to N113.53bn.

Meanwhile, total foreign transactions increased by 2.86 percent from N120.83bn to N124.28bn between April and May 2024.