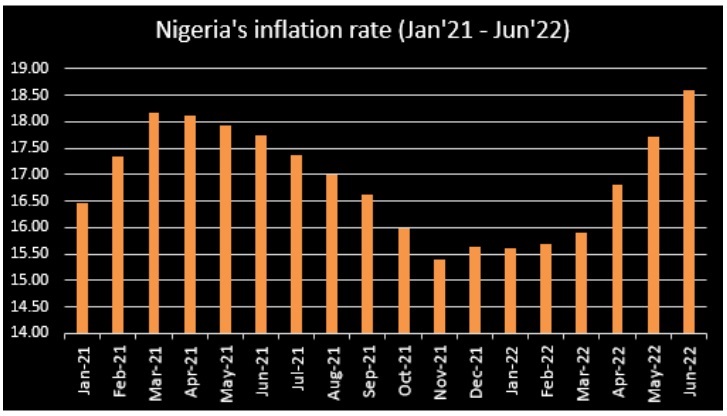

As Nigeria’s inflationary pressure enters its seventh successive month rise, judges are projecting a further rise in the months ahead due to spending associated with the 2023 general election.

Reporting for July history, the National Bureau of Statistics, NBS, has put the figure at19.64 percent in July, the loftiest in 16 times.

T

The NBS report in its Consumer’s Price indicator, CPI, for July also said food affectation rose to22.02 percent from20.6 percent in June.

The Bureau stated “ CPI for July 2022 was463.6 relative to387.5 in July 2021. In July 2022, on a time- on- time base, the caption affectation rate was19.64 percent. This was2.27 percent points advanced compared to the rate recorded in July 2021, which was(17.38 percent).

“ This shows that the caption affectation rate increased in July 2022 when compared to the same month in the former time( i.e., July 2021).

“ This means that in July 2022 the general price position was2.26 percent more advanced than in July 2021.

On food affectation, the Bureau said “ The food affectation rate in July 2022 was22.02 percent on a time- on- time base; which was0.99 percent advanced compared to the rate recorded in July 2021(21.03 percent).

“ This rise in food affectation was caused by increases in prices of chuck and cereals, food products, potatoes, yam and other tubers, meat, fish, oil painting, and fat. ’’

opening on the development, judges at Coronation Merchant Bank said that the rise in affectation will further spark another rise of the Central Bank of Nigeria, CBN, Monetary Policy Rate( MPR) at the forthcoming Monetary Policy Committee meeting listed coming week.

“ The CBN’s in-house estimates suggest that affectation is anticipated to remain vastly high, incompletely due to the figure-up of increased spending related to the 2023 general choices.

“ We anticipate data releases similar as the alternate quarter of this time( Q2 ’ 22) public accounts and August affectation report to give guidance on the MPC’s policy station at its September meeting.

“ This is largely due to the commission’s resoluteness to restore price stability while furnishing necessary support to the frugality.

“ In our view, another rate hike in September isn’t far- brought. The MPC is listed to hold its coming meeting on the 26th and 27th of September 2022. ”